- Joined

- Jul 23, 2015

- Messages

- 18,952

After the end of the $800 De Minimis exception for tariffs on goods shipped from Canada to the USA, my process for sending knives across the border has changed to help you avoid tariffs.

CUSMA Exemptions

Goods originating in Canada, the USA, or Mexico remain exempt from tariffs under the Canada–US–Mexico Agreement (CUSMA). However, the shipping process itself has become more complicated, especially with Canada Post.

Canada Post Changes

Canada Post now requires senders to prepay tariffs through a specific app before shipping—even if the goods qualify for exemption under CUSMA. This requirement effectively blocks standard shipment creation unless the prepayment system is used.

Switching to FedEx

FedEx offers a more manageable alternative. With FedEx:

I don’t need to prepay tariffs before dispatch.

I can include a Certificate of Origin declaring the goods as Canadian-made, which should exempt them under CUSMA.

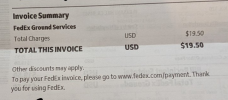

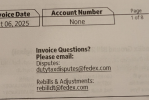

Be aware, FedEx may issue brokerage fee invoices to recipients after delivery. For instance, a recent shipment of 20 knives resulted in a $40 brokerage fee billed later.

For now, this FedEx route seems the most reliable and cost-effective option for U.S. customers—at least until the CUSMA comes up for revision in July 2026, at which point we will review any changes to the situation and pursue the most logical course they dictate.

Pricing Updates

Because of these new processes, I’m adjusting my base prices. They used to include Canada Post shipping, but from now on my base prices will simply be for the knife (and sheath, if the knife includes one).

Steel and Origin Requirements

Recent shipments through FedEx introduced an additional compliance step. FedEx Logistics requested details on the Country of Smelt and Pour for steel components in my knives. This relates to U.S. Section 232 regulations, which apply duties based on the country of metal origin.

FedEx explained that:

Steel requirements include declaring where the steel was melted and poured.

Aluminum requirements involve where the metal was smelted and cast. (not applicable to my work)

Metals processed outside Canada, the USA, or Mexico may face a 25%-35% duty under these rules.

Key Takeaway

Tariffs apply only to the value of the steel (if the steel was produced outside North America, such as AEB-L), not the value of the entire knife. This clarification significantly reduces potential duty amounts.

People need to be aware of the real possibility , while rare, U.S. Customs may still deny preferential tariff treatment even with complete documentation. If that happens, the FedEx invoice sent to the receiver after the package is delivered will also include tariffs. However, there is an email address on the invoice for disputing tariffs, and if it does happen that tariffs are incorrectly assessed, I encourage you to contact them before paying the invoice, and I will support you with any documentation needed to prove the knife was indeed made in Canada.

I am willing to do the extra it takes to continue to serve my fine friends south of the border.

CUSMA Exemptions

Goods originating in Canada, the USA, or Mexico remain exempt from tariffs under the Canada–US–Mexico Agreement (CUSMA). However, the shipping process itself has become more complicated, especially with Canada Post.

Canada Post Changes

Canada Post now requires senders to prepay tariffs through a specific app before shipping—even if the goods qualify for exemption under CUSMA. This requirement effectively blocks standard shipment creation unless the prepayment system is used.

Switching to FedEx

FedEx offers a more manageable alternative. With FedEx:

I don’t need to prepay tariffs before dispatch.

I can include a Certificate of Origin declaring the goods as Canadian-made, which should exempt them under CUSMA.

Be aware, FedEx may issue brokerage fee invoices to recipients after delivery. For instance, a recent shipment of 20 knives resulted in a $40 brokerage fee billed later.

For now, this FedEx route seems the most reliable and cost-effective option for U.S. customers—at least until the CUSMA comes up for revision in July 2026, at which point we will review any changes to the situation and pursue the most logical course they dictate.

Pricing Updates

Because of these new processes, I’m adjusting my base prices. They used to include Canada Post shipping, but from now on my base prices will simply be for the knife (and sheath, if the knife includes one).

Steel and Origin Requirements

Recent shipments through FedEx introduced an additional compliance step. FedEx Logistics requested details on the Country of Smelt and Pour for steel components in my knives. This relates to U.S. Section 232 regulations, which apply duties based on the country of metal origin.

FedEx explained that:

Steel requirements include declaring where the steel was melted and poured.

Aluminum requirements involve where the metal was smelted and cast. (not applicable to my work)

Metals processed outside Canada, the USA, or Mexico may face a 25%-35% duty under these rules.

Key Takeaway

Tariffs apply only to the value of the steel (if the steel was produced outside North America, such as AEB-L), not the value of the entire knife. This clarification significantly reduces potential duty amounts.

People need to be aware of the real possibility , while rare, U.S. Customs may still deny preferential tariff treatment even with complete documentation. If that happens, the FedEx invoice sent to the receiver after the package is delivered will also include tariffs. However, there is an email address on the invoice for disputing tariffs, and if it does happen that tariffs are incorrectly assessed, I encourage you to contact them before paying the invoice, and I will support you with any documentation needed to prove the knife was indeed made in Canada.

I am willing to do the extra it takes to continue to serve my fine friends south of the border.